As the healthcare industry continues to shift to a consumer-centric strategy, a growing number of providers are implementing site selection models to guide their real estate decisions. Real estate site selection models come with many unfamiliar terms, which can feel daunting to first time purchasers.

In this blog, we’ll explain the three most common types of healthcare site selection models so you can have more informed conversations with potential real estate partners.

Related: Guide to Urgent Care Site Selection Process

Defining Healthcare Site Selection Models

Before diving into the three most common healthcare site selection models, it’s essential to first answer the question, “What is a site selection model?”

Healthcare site selection models combine data-driven insights to evaluate potential facilities based on attributes that best correlate with successful locations. In healthcare, site selection involves evaluating sites both quantitatively and qualitatively to identify the ones that best position the organization for success, and a site selection model can enhance the quantitative side of the analysis. Buxton's approach to developing these models begins by analyzing patient, transaction/visit history, and location data, then integrating it with demographic, psychographic, and other performance-driving variables like competition, cotenancy, and area draw.

Methodologies vary based on the type of model, but may include both univariate and multivariate analyses, such as correlation analysis and logistic regression, to identify key factors driving site performance. Ultimately, these models enable healthcare organizations to optimize site selection, ensuring locations align with patient needs and community profiles.

Types of Healthcare Site Selection Models

Now that we’ve defined what a site selection model is, let’s explore the different types of models to discover which one is right for you.

Industry Site Score Model

What is it? An industry site score model is a theoretical model developed based on factors that are believed to influence performance for a specific healthcare service line, sub-service line, or facility type. The model leverages many data sources and may use variables such as area draw, supply of providers, demand, core consumer profile, and more. Because the model is based on industry experience and entirely pre-built, no actual patient data is required.

What is the output of the model? Industry site score models function mainly as benchmarking tools, as they produce an index score that tells you how the site compares to a benchmark set of comparable locations based on the variables included in the model. If a score of 100 represents the average characteristics around benchmark locations, then a 120 score indicates the site has 20% more favorable characteristics than the benchmark locations. This optimization allows businesses to prioritize high-potential locations.

Also, the site score sheet usually lists the individual variables that make up the overall score so you can see how it was derived.

Is it for me? Because industry site score models are pre-built, they can be used for organizations of all sizes and are the fastest models to implement. Some industry site score model providers may even offer features that allow you to configure some of the model settings to tailor the experience. These models are popular with health systems who offer many specialties and need separate models for each, organizations who would prefer not to share data with an analytics vendor, small specialty healthcare provider networks who are just beginning to grow their location count, and anyone who is simply seeking a cost effective and fast way to get started with site selection analytics.

Benchmark Site Score Model

What is it? A benchmark model is developed “from scratch” based on factors that are proven to correlate with an organization’s unique performance for a specific service line, sub-service line, or facility type. The process begins with analyzing your patient data, identifying the profile of the primary type of consumers you serve, and calculating how far those consumers travel to visit your locations. From there, other factors – such as healthcare provider supply, healthcare demand, favorable cotenants, and more – are tested to identify the combination of variables that best explain performance.

What is the output of the model? A benchmark model produces an index score that compares the expected performance of a site to your existing sites based on the variables included in the model. The site score sheet usually lists the individual variables that make up the overall score, so you can dive deeper into understanding the site’s dynamics.

Is it for me? If you have 21-50 locations that 1) offer the service line being modeled or are of a single facility type, 2) have been open for at least a year, and 3) will share patient data, then a benchmark model is likely a great fit for you. This model type is popular with retail health and other specialty health organizations. Some health systems choose to use a benchmark model for their primary care locations but use industry models for other specialties since those models don’t have minimum location count requirements.

Forecasting Site Score Model

What is it? A forecasting site score model is the most complex of the three site selection model types. It uses linear regression to provide a forecast for a specific performance indicator, such as the number of visits or projected revenue. The forecasting model includes many of the same variables as the benchmark model but goes beyond the benchmark model by examining how your locations affect each other, which is referred to as “cannibalization.”

What is the output of the model? Unlike an industry or benchmark model, a forecasting model produces an actual performance forecast, such as 7,500 annual visits. Index scores and/or raw values for the underlying variables are usually provided.

Is it for me? Producing a statistically reliable forecast requires a large sample set of good quality location performance data. Healthcare providers with 51+ locations that 1) offer the service line being modeled or are of a single facility type, 2) have been open for at least a year, and 3) will provide location, patient and encounter data, typically have the data required to develop a forecasting model. For many health systems, a forecasting model may not fit based on the requirements, but it may be a great fit for a retail health or specialty health organization.

Benefits of Using Healthcare Site Selection Models

Using healthcare site selection models enables providers to strategically place facilities where they can have the greatest impact. As a result, these models have the power to enhance patient accessibility, elevate healthcare outcomes, and improve operational efficiency to better serve the community.

Improved Patient Accessibility

Strategic site selection directly impacts patient accessibility. By choosing locations near underserved populations or transportation hubs, healthcare providers can ensure more people have access to essential services. Increased accessibility often leads to earlier interventions and better healthcare outcomes, as patients are more likely to seek timely care when facilities are conveniently located.

Enhanced Healthcare Outcomes

Proper site selection doesn’t just improve access; it directly influences healthcare outcomes. Locating facilities in areas with high demand allows for faster response times, improved patient care, and more tailored services. By reducing barriers to care, these models help healthcare providers meet patient needs more effectively and efficiently, leading to better overall health results and patient satisfaction.

Optimized Operational Efficiency

Healthcare site selection models drive operational efficiency by helping your organization to select sites with the right balance of demand for healthcare services and current supply of care for those services. By identifying sites in markets that are not yet saturated, your organization can operate more efficiently and maximize the return on the location investment.

How to Choose the Right Healthcare Site Selection Model

Choosing the right healthcare site selection model requires careful evaluation of your organization's objectives, data sources, and technology needs. By aligning these factors, you can implement a model that best supports patient access, operational efficiency, and long-term success.

Assessing Organizational Needs

Before choosing a healthcare site selection model, organizations must evaluate their unique objectives and operational structure. This initial assessment ensures the model fits the organization’s goals, service offerings, and market presence. For example, are you seeking a detailed forecast for well-established service lines, or a directional tool to help you quickly and cost effectively explore new markets? Aligning the model with strategic goals ensures that the site selection process supports long-term growth and operational efficiency.

Evaluating Available Data Sources

The foundation of any site selection model is data. In healthcare, this means considering both traditional and retail-oriented data sources. Key data points include healthcare-specific metrics, such as provider supply and service demand, alongside retail data, like complementary businesses and area draw. These diverse sources ensure that the model reliably predicts patient behavior and site performance. Look for a model provider who takes both types of datasets into account.

Furthermore, some model types are fully customized to your business, which means you need to determine if your organization is able and willing to share data with your modeling partner. Look for model providers who comply with rigorous security standards or opt for a version of the model that doesn’t require access to your data.

Integrating Technology in Site Selection

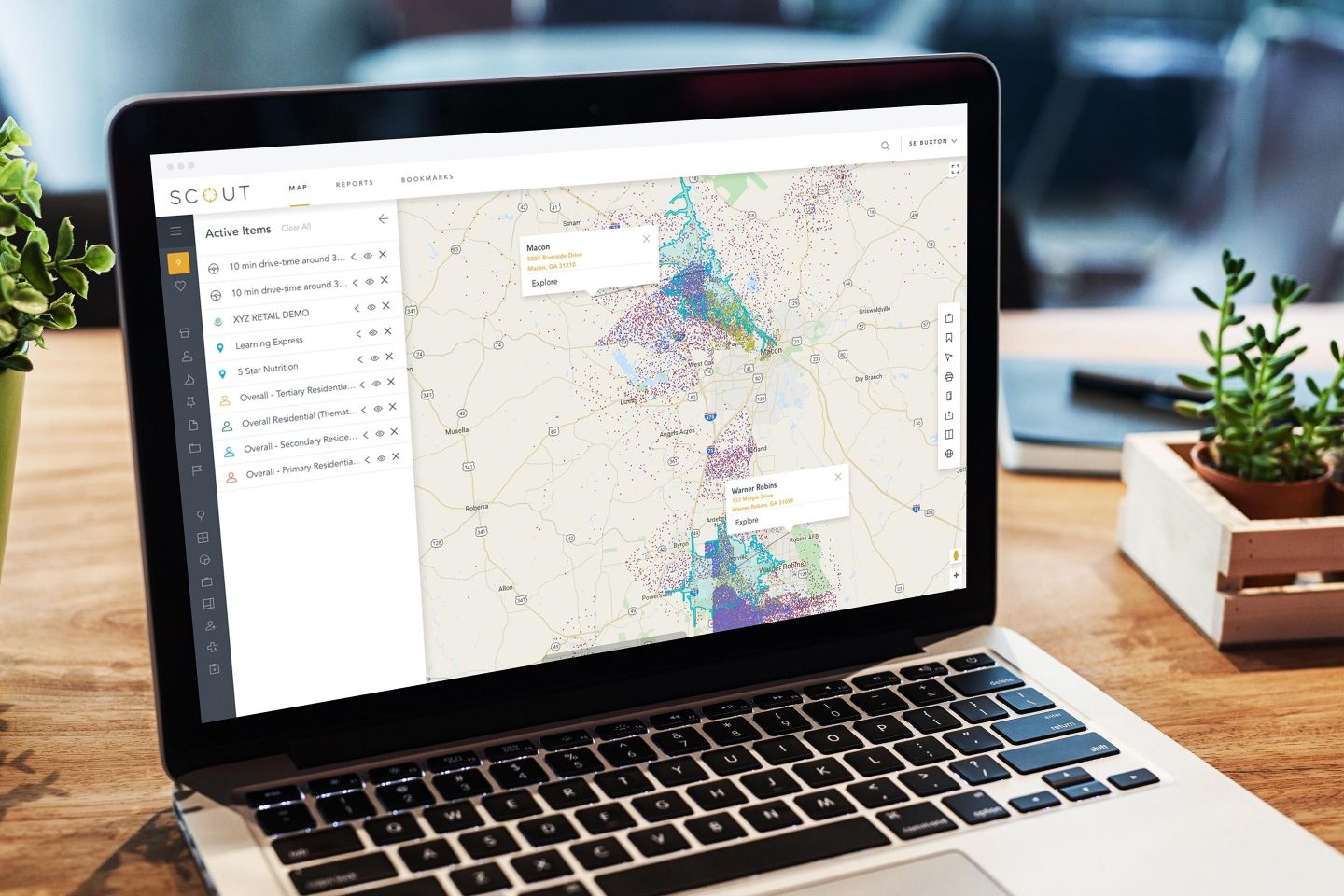

Technology plays a pivotal role in modern healthcare site selection. Advanced analytics platforms make site selection models accessible and offer other tools for data visualization, reporting, and ongoing analysis. These innovations are transforming healthcare site selection from an art to a modern science.

Related: Urgent Care Site Selection Process and Key Factors to Consider

If you are looking for a partner who can help you make the right healthcare site selection decisions, consider working with Buxton. Explore our solutions for health systems and specialty health providers to learn more.